SmartVAT – An NBR Enlisted VAT Software

Why SmartVAT Software?

SmartVAT is a VAT Management Software that covering all categories of your VAT Registered business authorized by the National Board of Revenue (NBR). Additionally, this VAT Software can be integrated with any third-party application. Especially, data fetching and migrations become a key advantage of our application. VAT Software is used to keep track of sales, purchases, inventory, production, and also payment transactions before generating government-mandated reports. Whereas, users can also directly apply a final VAT return to the government system (iVAS in Bangladesh) using the SmartVAT Software. Our SmartVAT is a one-of-a-kind VAT Software for seamlessly managing VAT operations in accordance with the National Board of Revenue's (NBR) compliance with the VAT Act of 2012 accordingly. Significantly, SmartVAT Software was created by a unique team led by some young buds, and the entire architecture was described by a certified VAT Consultant in Bangladesh with over 27 years of experience on VAT. The DI System fully follows the NBR guideline accordingly compliant with VAT & SD ACT 2012, as of GO-16/VAT/2019. The systems interface is readable and easy to use, and features are topnotch therefore it's a user-friendly VAT Software system for every business. Specifically, SmartVAT Software is developed keeping compatibility with the new VAT and Supplementary Duty Rules 2016. Hence, managers do not need to think about keeping records for every transaction or keeping a separate account only for VAT calculations because SmartVAT Vat Software will be taken care of those tasks smoothly.

Global Access

NBR Approved

Integration

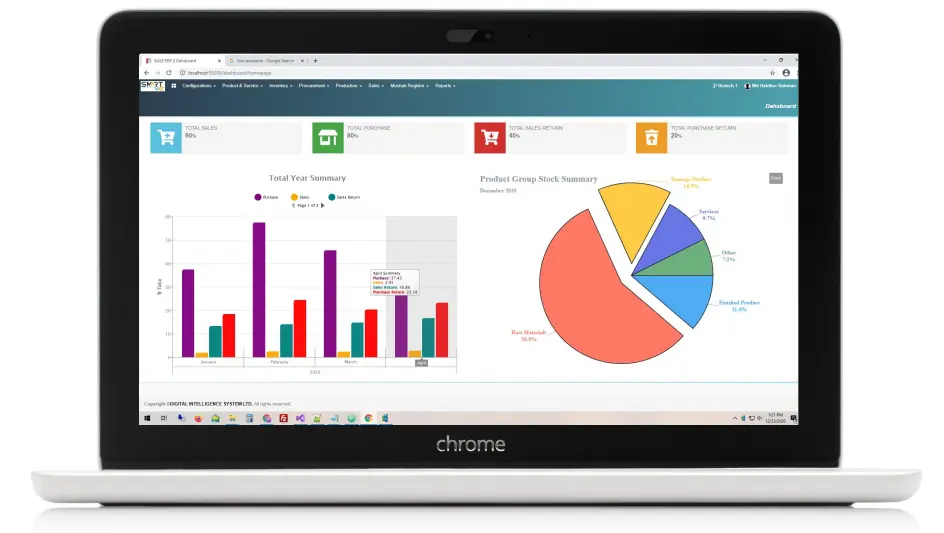

Detail Reporting

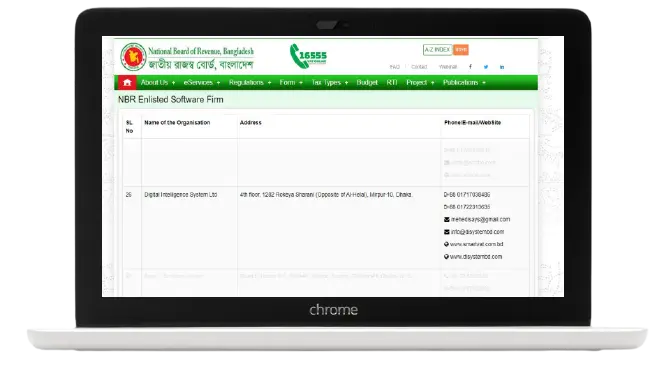

NBR Approved

Approved by the National Board of Revenue (NBR), "SmartVAT" Vat Software also complies with the VAT & SD Act 2012.

NBR Enlistment!

Third-Party Integration

Set a timeline, to plan projects right the first time. See how the pieces fit together so you can spot gaps and overlaps before you start.

Contact Us

Extensive Reporting

Use Reports to plan projects right the first time. See how the pieces fit together so you can spot gaps and overlaps before you start.

Request a Demo!Mushak (VAT & SD Act 2012)

- Mushak - 4.3 : Input-Output Coefficient Declaration

- Mushak - 6.1 : Purchase Accounts Book

- Mushak-6.2 : Sales Accounts Book

- Mushak - 6.2.1 : Purchase & Sales Account Book

- Mushak - 6.3 : Tax Invoice

- Mushak - 6.4 : Invoice of contractual production

- Mushak - 6.5 : Invoice for transfer of goods

- Mushak - 6.6 : VDS Certificate

- Mushak - 6.7 : Credit Note

- Mushak - 6.8 : Debit Note

- Mushak - 6.9 : Turnover Tax Invoice

- Mushak - 6.10 : Purchases/Sales valued 2 lac+ Taka

- Mushak - 9.1 : Value Added Tax Return

- Mushak - 9.2 : Turnover Tax Return

Why Companies Need Vat Software?

All of a sudden, Companies may wonder why they need VAT Management Software after 30 years of manually reporting VAT in paper-based documents. In detail, there’s a two-part answer to the question.

INTRICATE CALCULATIONS MADE EASY:

The process of calculating VAT is quite complicated. The business has to be paid taxes after added value on different steps of production and distribution segment. Similarly, there are some different rules applied on tax calculation for raw materials, finished goods, and on work in progress section. For some reason, the company has to buy same raw material from different suppliers, such as a furniture company buying the same Mahogany wood from different sellers at different prices, in this case, tax calculation would be different in each segment. For this reason, the VAT estimation will be difficult to manage. For instance, SmartVAT Management Software can make the process much more easy, quick, and effective.

RECORD KEEPING AND TRANSPARENCY:

In our country, they are not well trained to calculate the value of recording for keeping goods/services convention. Hence, when NBR willing to see detailed records of any transaction, companies failed to provide those reports. In these situations, VAT software gives strong support for all businesses. Meanwhile, companies can provide each transactions reports as they recorded properly in the system so, the business doesn’t have to worry to provide reports if they faced any audit in the future because the system provided the authentic reports accordingly.

© 2021 Digital Intelligence System Limited. All rights reserved.